Changes in Interest Rates Cause a Shift in

Changes in interest rates ceteris paribus cause a shift in. But it was Fed Chairman Jerome.

When a shift occurs in the ISLM Model you need to figure out the direction of the shift and then find the new equilibrium point to see what direction the change in equilibrium interest rate and GDP will be.

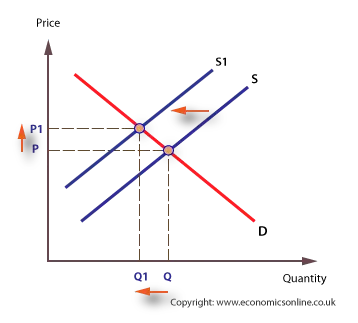

. When the equilibrium is at point E 1 the rise in money supply shifts the LM curve to the right creates excess of money supply and decreases the interest rate. Higher interest rates tend to moderate economic growth. Supply and DemandInterest rate levels are a factor of the supply and demand of credit.

A change in interest rates for some other reason shifts the curve. An increase iInflationInflation will also affect interest rate levels. Which payment method typically charges the highest interest rates.

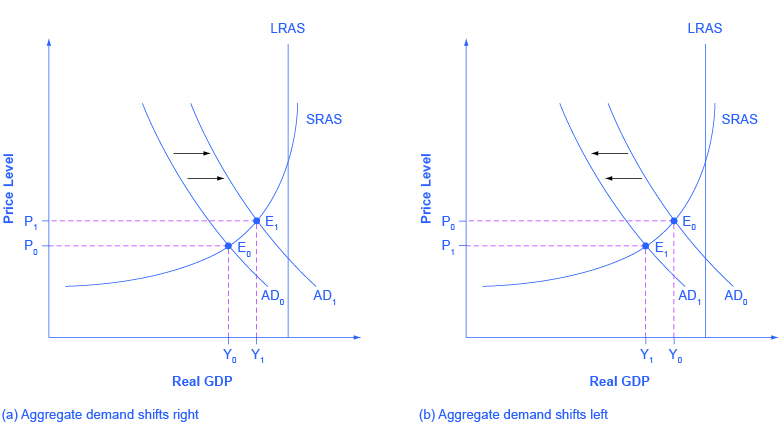

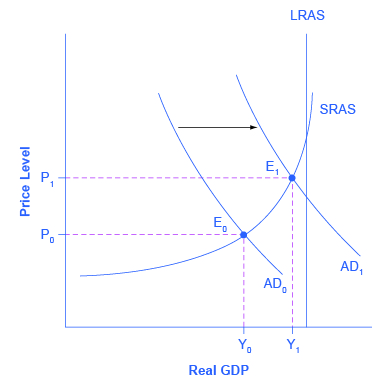

Higher interest rates increase the cost of borrowing reduce disposable income and therefore limit the growth in consumer spending. Economic growth would pressure the interest rate to increase while economic decline would influence the interest rate to go down. That will lead to a shift in the interest rate will cause but the aggregate demand is.

Suppose that one-year five-year eight-year ten-year 15-year 20-year and 30-year bonds all. As a result of increased money supply interest rates decline from i 1 to i 2 and aggregate level of output increased from Y 1 to Y 2. Interest is simply the cost of borrowing money.

Changes in interest rates ceteris paribus cause a shift in A neither the investment demand curve nor the aggregate demand curve. A change in curvature depends mainly on how the yields on medium term maturities have changed in relation to the yields on short and longer term maturities. Higher interest rates have various economic effects.

The aggregate demand curve but not the investment demand curve Assuming that the Federal Reserve Banks sell 40 million in government securities to commercial banks and the reserve requirement is 20 then the effect will be to reduce _____. The aggregate demand curve but not the investment demand curve. C the aggregate demand curve but not the investment demand curve.

This causes current C to decrease and the IS curve to shift left. Question Changes in interest rates holding other factors constant cause a shift in Select an answer and submit. Correct answer is A when interest rate change other factors keep constant so there is a movemnet along the investment curev and aggregate demand View the full answer Transcribed image text.

An increase in the money supply will lower the interest rate increase investment spending and increase aggregate demand and GDP. Higher interest rates tend to discourage borrowing and thus. For example the Federal Reserve can affect interest rates and the availability of credit.

The aggregate demand curve but not the investment demand curve. An increase in the future expected interest rate will cause a reduction in the present value of future disposable income and therefore human wealth. The investment demand curve and the aggregate.

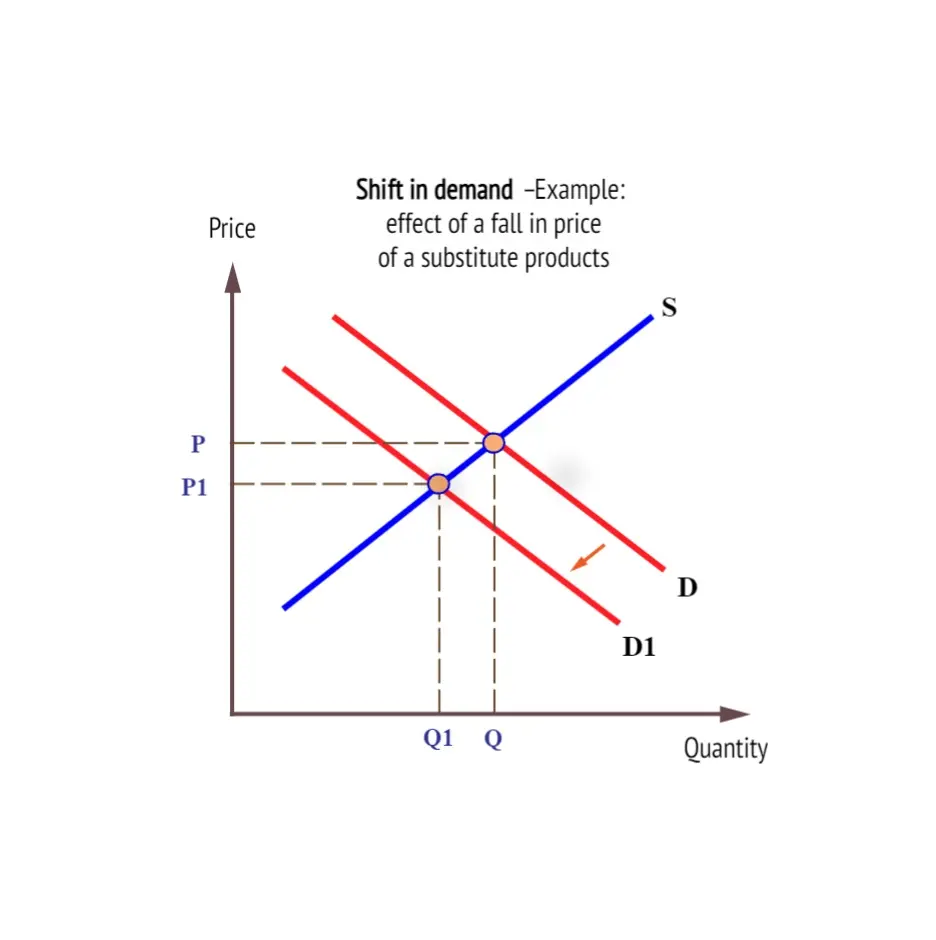

When quantity demanded or supplied changes as a result of a change in the price of the bond or equivalently a change in the interest rate Shift in the demand or supply curve Occurs when the quantity demanded or supplied changes at each given price or interest rate of the bond in response to a change in some other factor besides the bonds price or interest rate. Such a change would shift the yield curve parallel to its present place on the graph without changing its slope. Which payment method typically charges the highest interest rates everfi.

For more examples or if you would like to. A parallel shift in the yield curve happens when the interest rates on all fixed-income maturities increase or decrease by the same number of basis points. So when we look at economic indicators over the past year the 10-year approaching 3 has not led to a reduction in aggregate supply.

An increase in the money supply all else held constant usually. Changes in interest rates ceteris bartleby. Some might argue that this could lead to.

The higher the inflation rate the mo. Here the discussion will sketch two broad categories that could cause AD curves to shift. Interest rates are the annual charge for borrowing.

Changes in the behavior of consumers or firms and changes in government tax or spending policy. Changes in interest rates holding other factors constant cause a shift in Neither the investment demand curve nor the aggregate demand curve The investment demand curve but not the aggregate demand curve. Changes in economic conditions that shift supply and demand curves for loanable funds will change the equilibrium interest rate.

Changes in interest rates all else held constant cause a shift in. The aggregate demand curve but not the investment demand curve. Changes in interest rates ceteris.

As a general rule of thumb when the Federal Reserve cuts interest rates it causes the stock market to go up. Subsequently investment expenditures and net export rise which leads to an. What causes changes in interest rates.

Depending on the cause of the shift we may see the new interest rate increase or decrease and the new GDP level may do the same. D the investment demand curve and the aggregate demand curve. The increase in the future expected rate will also cause a reduction in the present value of future profits.

On Wednesday central bank officials approved a half-percentage-point interest rate increase lifting the federal-funds rate to a target range between 075 and 1. The level of GDP ceteris paribus will tend to increase when. Also changes in inflationary expectations can affect the interest rates by.

As with any good or service in a free market economy price ultimately boils down to supply and demand. Changes in interest rates all else held constant cause a shift in _____. B the investment demand curve but not the aggregate demand curve.

What would most likely happen if the federal reserve system lowered interest rates. When the Federal Reserve raises interest rates it causes the stock market to go down. The federal reserve has kept interest rates very low.

A positive butterfly shift implies a previous bulge in the yield curve is now flattened. A change in the curvature is sometimes called as a butterfly shift in the yield curve. Higher interest rates tend to reduce inflationary pressures and cause an appreciation in the exchange rate.

When demand is weak lenders charge less to. Decreases the interest rate and increases the aggregate demand.

Shifts In Aggregate Demand Article Khan Academy

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

No comments for "Changes in Interest Rates Cause a Shift in"

Post a Comment